In today’s world of travel, credit cards offering travel rewards have become a game-changer for savvy travelers. These cards provide an opportunity to earn points or miles on everyday purchases, which can be redeemed for flights, hotel stays, and other travel experiences. With the right card, travelers can significantly reduce their travel costs and enjoy exclusive perks, making their journeys more affordable and comfortable.

As we enter 2024, the landscape of travel rewards credit cards continues to evolve, with issuers competing to offer the best value to cardholders. This article delves into the top travel rewards cards of the year, breaks down how these programs work, and explores strategies to maximize earnings and redemptions. It also covers the various travel perks and benefits these cards provide, helping readers choose the best credit card for travel rewards that suits their specific needs and travel goals.

Top Travel Rewards Cards of 2024

Chase Sapphire Preferred® Card

The Chase Sapphire Preferred® Card stands out as a top choice for travel enthusiasts in 2024. With its attractive sign-up bonus, cardholders can earn 60,000 bonus points after spending $4,000 on purchases within the first three months of account opening. This bonus translates to $750 when redeemed for travel through Chase Travel℠, offering significant value right from the start.

The card’s earning structure is designed to reward frequent travelers and diners. Cardholders earn 5 points per dollar on travel booked through Chase, 3 points on dining, select streaming services, and online grocery purchases, 2 points on general travel purchases, and 1 point on all other purchases. This tiered rewards system allows users to maximize their point earnings across various spending categories.

One of the card’s standout features is its flexibility in point redemption. Points can be transferred to Chase’s travel partners at a 1:1 ratio, potentially increasing their value even further. Additionally, cardholders receive a 10% point bonus on their account anniversary, adding extra value to their rewards.

The Chase Sapphire Preferred® Card also offers valuable travel protections, including primary rental car insurance, trip cancelation/interruption insurance, and baggage delay coverage. These benefits can provide peace of mind and potential savings for travelers.

With an annual fee of $95, the Chase Sapphire Preferred® Card offers a balance of rewards and benefits that can easily outweigh the cost for frequent travelers.

Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card is an excellent option for those seeking simplicity in their travel rewards. It offers a generous initial bonus of 75,000 miles after spending $4,000 within the first three months of account opening, worth $750 when redeemed for travel.

One of the card’s key strengths is its straightforward earning structure. Cardholders earn 2 miles per dollar on most purchases, effectively providing a 2% return when redeemed for travel. Additionally, hotels and rental cars booked through Capital One Travel earn 5 miles per dollar spent.

The Capital One Venture card stands out for its flexibility in redemption. Cardholders can use their miles to cover any travel-related charges that appear on their statement, offering freedom in booking options. This feature is particularly beneficial for those who prefer to shop around for the best travel deals.

With a $95 annual fee, the card offers good value, especially considering the initial bonus covers more than seven years of annual fees. The card also provides travel benefits such as a Global Entry or TSA PreCheck application fee credit and travel accident insurance.

American Express® Gold Card

The American Express® Gold Card is a strong contender in the travel rewards space, particularly for food enthusiasts. The card offers 4x Membership Rewards points at U.S. supermarkets (up to $25,000 per year) and at restaurants worldwide.

Cardholders can benefit from various statement credits, including up to $120 in annual Uber Cash and up to $120 in annual dining credits at select partners. These credits can significantly offset the card’s $325 annual fee.

The card’s travel benefits include no foreign transaction fees and secondary car rental insurance. Points earned can be transferred to Amex’s airline and hotel partners, potentially increasing their value.

The Platinum Card® from American Express

For luxury travelers, The Platinum Card® from American Express offers an unparalleled suite of benefits. Despite its high $695 annual fee, the card provides extensive value through various credits and perks.

Cardholders receive up to $200 in annual airline fee credits, $200 in Uber credits, $100 at Saks Fifth Avenue, and more. The card also offers unmatched lounge access, including Centurion Lounges, Delta Sky Clubs (when flying Delta), and Priority Pass Select lounges.

The earning structure includes 5x points on flights booked directly with airlines or through Amex Travel (on up to $500,000 per calendar year) and 5x points on prepaid hotels booked through Amex Travel.

Chase Sapphire Reserve®

The Chase Sapphire Reserve® is a premium travel card offering high-value benefits. Cardholders earn 10x total points on hotels and car rentals purchased through Chase Travel, 5x points on flights booked through Chase, and 3x points on other travel and dining.

The card’s $300 annual travel credit effectively reduces the $550 annual fee to $250 for frequent travelers. Additional perks include Priority Pass lounge access, Global Entry/TSA PreCheck credit, and comprehensive travel insurance.

The Chase Sapphire Reserve® also offers excellent redemption value, with points worth 50% more when redeemed for travel through Chase Ultimate Rewards.

Understanding Travel Rewards Programs

Travel rewards programs have become increasingly popular among credit card users, offering a variety of ways to earn and redeem points or miles for travel-related expenses. To make the most of these programs, it’s essential to understand the different types of rewards and how they work.

Points vs. Miles

The distinction between points and miles often comes down to how the issuer designates its rewards currency. Miles typically refer to airline-specific rewards that can be redeemed for free flights, while points are usually more flexible and can be used for various travel-related expenses.

Credit cards that earn miles are generally co-branded with a specific airline. These cards allow users to accumulate frequent-flyer miles with every purchase, which can then be redeemed for flights on that particular airline. On the other hand, cards that earn points often provide more flexibility in how rewards can be used.

Points-earning cards, also known as general travel cards, accumulate rewards in the issuer’s currency. These points can be used in several ways, including booking travel through the issuer’s portal, redeeming for statement credits against travel purchases, or transferring to participating frequent traveler programs.

Transferable Points

Transferable points are considered the most valuable type of currency in the world of travel rewards due to their versatility. Major issuers like American Express, Bilt, Capital One, Chase, and Citi offer credit cards that earn transferable points, which can be moved to various airline and hotel partners.

The key advantage of transferable points is the flexibility they provide. Instead of being limited to a single airline or hotel program, cardholders can leverage their rewards to book the best available option for the lowest possible price. This flexibility can be particularly valuable when looking to travel in premium cabins or minimize the number of points redeemed for an award.

For example, American Express Membership Rewards points are highly valued at 2 cents per point, according to TPG’s latest valuations. These points can be transferred to partners like All Nippon Airways (ANA) Mileage Club and Delta SkyMiles, offering unique redemption opportunities.

Co-Branded Cards

Co-branded travel credit cards are issued by banks in partnership with specific airline or hotel loyalty programs. These cards earn rewards in the form of the partner’s loyalty currency and often come with brand-specific perks.

For airline co-branded cards, these perks typically include free checked bags, priority boarding, in-flight discounts, and other frequent flyer benefits. Hotel co-branded cards often offer annual hotel credits or automatic elite status.

Co-branded cards are best suited for travelers who frequently use the same airline or hotel brand, as they allow users to earn and redeem rewards within a specific travel program. However, they offer less flexibility compared to general travel credit cards.

In contrast, general travel credit cards provide more options for earning and redeeming rewards. These cards allow users to earn points that can be used in various ways, including transfers to multiple airline and hotel loyalty programs, travel purchases through the issuer’s portal, or even statement credits for travel expenses.

Earning Travel Rewards

Sign-Up Bonuses

Sign-up bonuses have become a powerful tool for travelers to quickly accumulate rewards. As of July 2024, the average sign-up bonus for premium travel rewards cards has increased by 37% compared to 2023, reaching an all-time high of 175,000 points. This surge in bonus offerings has made it possible for 82% of cardholders who strategically apply for sign-up bonuses to accumulate enough points for a round-trip business class ticket to Europe within 6 months.

The landscape of sign-up bonuses has evolved, with 64% of new card offerings now featuring tiered bonus structures that reward higher spending levels. This approach allows cardholders to maximize their initial rewards by meeting specific spending thresholds. Additionally, the average time between sign-up bonus eligibility for the same card has decreased from 48 months to 36 months across major issuers, enabling more frequent bonus harvesting.

Interestingly, 73% of millennials are now prioritizing cards with flexible redemption options over those with the highest nominal point values, indicating a shift in bonus valuation strategies. This trend has led to the emergence of “choose your own adventure” sign-up bonuses, where applicants can select from various reward types, resulting in a 22% increase in customer satisfaction scores for participating issuers.

Everyday Spending

Maximizing returns from travel rewards cards often involves strategically aligning spending with bonus categories like travel, dining, and groceries. To optimize returns, it’s crucial to assess personal spending habits and make informed decisions about where to allocate spending to maximize category-specific rewards.

Many credit cards offer increased points or cash back for specific spending categories. For example, the American Express® Gold Card provides a range of travel and dining benefits, including up to $120 worth of Uber Cash each year and up to $120 worth of annual dining credits when used with participating partners.

A study by the Financial Analytics Institute found that consumers who strategically use everyday rewards cards can save up to $1,200 annually compared to those primarily using travel rewards cards. In 2024, 73% of credit card users have shifted their focus to cards offering higher rewards on everyday purchases, with grocery and dining categories seeing the highest engagement.

Bonus Categories

Credit cards often offer bonus categories that allow cardholders to earn extra points or miles on specific types of purchases. For instance, the Chase Sapphire Preferred® Card offers bonus points on travel and dining expenses, making it an attractive option for those who frequently spend in these categories.

Some cards, like the Bank of America Customized Cash Rewards credit card, allow cardholders to choose their own bonus category, providing even more personalized reward optimization. This flexibility enables users to align their card’s rewards structure with their unique spending patterns.

The average return on everyday spending has increased from 5% to 8% over the past year, as card issuers compete for consumer attention in non-travel categories. Advanced AI algorithms are now being employed by card issuers to predict and offer personalized everyday reward categories, resulting in a 22% increase in customer satisfaction scores.

Redeeming Travel Rewards

Booking Through Travel Portals

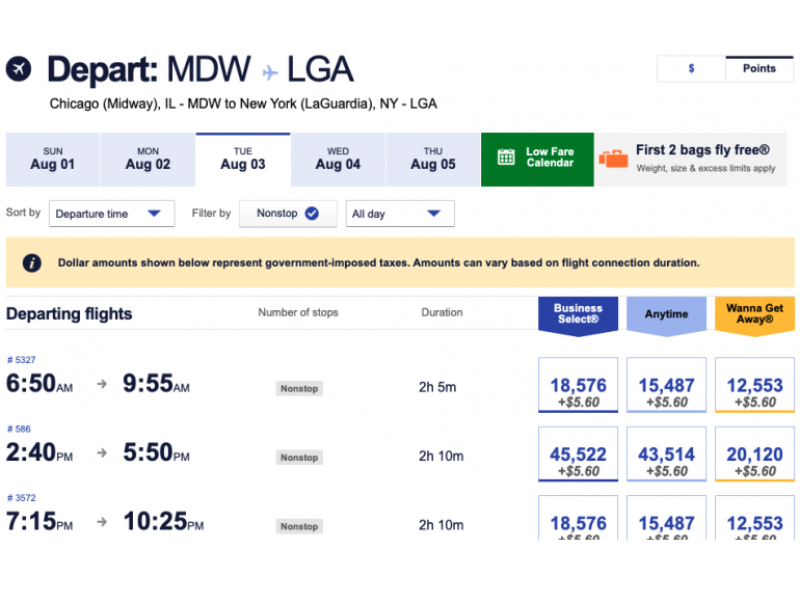

Travel rewards credit card holders can maximize their points by booking through dedicated travel portals. For instance, Capital One’s travel portal offers a user-friendly interface for booking flights, hotels, and rental cars. When booking airfare, cardholders can take advantage of flexible date options and color-coded calendars to find the best deals. It’s important to include frequent flyer numbers and Known Traveler Numbers during the booking process to ensure all benefits are applied.

The Capital One Venture Rewards card, which currently offers a welcome bonus of 75,000 miles after meeting spending requirements, allows cardholders to redeem miles at a rate of 1 cent each towards travel bookings. Alternatively, users can choose to pay with their Capital One credit card and save their miles for future use.

Transferring to Partners

Transferring points to airline and hotel partners often provides the best value for travel rewards. Chase Ultimate Rewards® points, for example, can be redeemed at higher values when transferred to partners. The Chase Sapphire Preferred® Card offers a redemption value of 1.25 cents per point, while the Chase Sapphire Reserve® increases this to 1.5 cents per point.

Some of the most valuable Chase transfer partners include World of Hyatt, Virgin Atlantic Flying Club, and JetBlue TrueBlue. World of Hyatt points, in particular, are estimated to be worth 2.3 cents each when used for award stays, making it one of Chase’s most valuable transfer partners.

When considering transfers, it’s crucial to compare prices between booking through the credit card portal and transferring to partners. For example, a $150 United Airlines flight would cost 15,000 Capital One miles through the portal, but might be available for just 7,500 Avianca LifeMiles plus minimal taxes and fees.

Statement Credits

Many premium travel cards offer statement credits to offset annual fees and provide additional value. These credits can be used for various purposes, including dining, travel, and specific merchant purchases.

For dining credits, cards like the American Express® Gold Card offer monthly credits that can be used for food delivery or dining out. To maximize these credits, consider ordering food for pickup to avoid delivery fees and service charges.

Travel credits are offered by cards such as the Chase Sapphire Reserve® ($300 general travel credit) and the U.S. Bank Altitude™ Reserve Visa Infinite® Card ($325 general travel/food credit). These credits automatically apply to qualifying purchases in the travel category.

When redeeming points for statement credits, the value can vary significantly between card issuers. For example, American Express Membership Rewards points are worth only 0.6 cents each when redeemed for statement credits, while Chase Ultimate Rewards® points can be worth up to 1.5 cents each for certain categories.

To redeem points for statement credits, cardholders typically need to navigate to the rewards section of their card issuer’s website or app. It’s important to note that different issuers have varying requirements and restrictions for statement credit redemptions, such as time limits on eligible purchases or minimum redemption amounts.

Travel Perks and Benefits

Airport Lounge Access

Airport lounges offer travelers a sanctuary to relax and recharge before flights, providing complimentary refreshments and private bathrooms. Many premium credit cards include lounge access as a benefit, granting entry to various types of lounges worldwide. For instance, The Platinum Card® from American Express provides access to over 1,400 Priority Pass lounges across 140 countries, as well as American Express Centurion℠ lounges, Delta Sky Club® lounges, and others.

The Chase Sapphire Reserve® offers Priority Pass membership, allowing cardholders and up to two guests to access more than 1,300 airport lounges in 148 countries. For Delta Airlines loyalists, the Delta SkyMiles® Reserve American Express Card provides access to Delta Sky Club® lounges and American Express Centurion℠ lounges when booking Delta flights.

Travel Insurance

Travel insurance is a crucial benefit offered by many credit cards, helping cardholders recover costs when travel plans go awry. The Chase Sapphire Reserve® stands out with its comprehensive coverage, including trip cancelation/interruption insurance up to $10,000 per person and $20,000 per trip, trip delay reimbursement up to $500 per person after six hours of delay, and lost luggage reimbursement up to $3,000.

Other notable benefits include auto rental collision waiver, providing primary insurance up to $75,000 for damages caused by theft or collision, and emergency medical and dental coverage up to $2,500. While these benefits are valuable, it’s important to note that they may not cover all scenarios, and additional travel insurance might be necessary for complete protection.

Global Entry/TSA PreCheck Credits

Many premium travel credit cards offer statement credits for Global Entry or TSA PreCheck application fees, allowing travelers to expedite their airport security and customs experiences. The Global Entry application fee is normally $100 ($120 starting Oct. 1, 2024), while TSA PreCheck costs at least $78.

Cards like the Capital One Venture X Rewards Credit Card, Chase Sapphire Reserve®, and The Platinum Card® from American Express offer reimbursement for these fees. Some cards, like the American Express Platinum Card, extend this benefit to authorized users at no additional cost. Additionally, certain airline co-branded cards, such as those from United and Delta, offer discounted CLEAR® Plus memberships, further enhancing the travel experience.

Choosing the Right Travel Rewards Card

Selecting the ideal travel rewards credit card requires careful consideration of personal travel habits, spending patterns, and financial goals. In 2024, the most efficient travel rewards cards offer an average 7% return on spending when points are redeemed for travel, compared to 5% for cash back cards. To maximize the benefits of these cards, travelers should assess their travel style, compare annual fees, and evaluate reward structures.

Assessing Your Travel Style

Before choosing a travel credit card, individuals should understand which type best suits their spending style and travel needs. Co-branded travel credit cards, issued in partnership with specific airline or hotel loyalty programs, are ideal for travel loyalists who frequently use the same brand. These cards often come with brand-specific perks such as free checked bags, priority boarding, and automatic hotel elite status.

For those seeking more flexibility, general travel credit cards allow users to earn rewards that can be used in various ways, including transfers to multiple airline and hotel loyalty programs. These cards are best for people who want to use rewards for travel without being tied to a specific brand.

Comparing Annual Fees

When evaluating travel rewards credit cards, it’s crucial to consider the annual fees and calculate the break-even points to ensure the card’s benefits outweigh the cost. For example, the Chase Sapphire Reserve card has a $550 annual fee, but it comes with a $300 annual travel credit, effectively reducing the annual fee to $250. Similarly, the American Express Gold Card has a $250 annual fee but offers up to $240 in annual statement credits, making the effective annual fee only $10.

Evaluating Reward Structures

The most lucrative travel cards offer bonus rewards in specific spending categories. For instance, some cards provide higher earning rates for travel, dining, or grocery purchases. Advanced AI algorithms now allow credit card issuers to tailor rewards structures to individual spending habits, with some cards offering up to 10x points in personalized bonus categories.

When comparing cards, consider the value of perks like lounge access, travel insurance, and foreign transaction fee waivers. For international travelers, it’s crucial to choose cards with no foreign transaction fees, as data analysis reveals that travelers using such cards save an average of $165 per international trip compared to those using cards with typical 3% fees.

Conclusion

The world of travel rewards credit cards has undergone significant changes in 2024, offering travelers more opportunities to maximize their benefits and savings. The top cards we’ve explored provide a range of perks, from generous sign-up bonuses to flexible redemption options and valuable travel protections. By understanding the nuances of different rewards programs and carefully assessing personal travel habits, consumers can choose a card that aligns with their lifestyle and goals.

To make the most of these travel rewards, it’s crucial to consider factors such as annual fees, earning structures, and additional benefits like lounge access or travel insurance. By doing so, travelers can turn everyday spending into memorable experiences, whether it’s a luxurious hotel stay, a first-class flight, or simply more affordable travel overall. In the end, the right travel rewards card can be a powerful tool to enhance the travel experience and open up new possibilities for exploration.

FAQs

Which credit cards do millionaires typically use?

Millionaires often use exclusive credit cards such as the Centurion® Card from American Express and the J.P. Morgan Reserve Credit Card. These cards are invitation-only and cater to individuals with high spending capabilities.

What are the top credit cards recommended for use during travel?

When traveling, the best credit cards to use include:

- American Express® Gold Card for dining perks.

- Chase Sapphire Preferred® Card for a substantial welcome bonus.

- Capital One Venture Rewards Credit Card for a low annual fee.

- Discover it® Miles for no annual fee.

- Credit One Bank® Wander® American Express® Card for those with fair credit.

What are some of the most exclusive credit cards available by invitation only?

Some of the most secretive and exclusive credit cards include:

- Centurion® Card from American Express

- J.P. Morgan Reserve Card

- Dubai First Royale Mastercard

- Coutts Silk Charge Card

- Citigroup Chairman American Express Card These cards are typically reserved for the ultra-wealthy and require an invitation to apply.